Winnipeg Economic Digest (WED), Volume 2, Issue 2

Manitoba Business Leaders Index: Summary

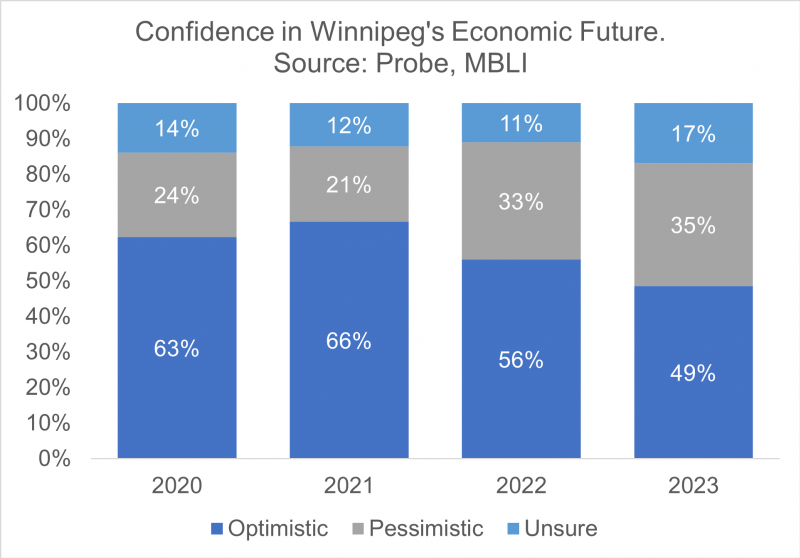

Probe’s Manitoba Business Leaders Index (MBLI) highlights Manitoba business leaders’ thinking from year to year. While many participating organizations reported seeing revenues improve, they are concerned about the future, still due to the pandemic.

Specific concerns are inflation, talent attraction and retention, and supply chain disruption. These three issues all show signs of improvement, but they have not been entirely resolved. Some industries still have issues hiring staff and some sources of inflation will take time to clear.

Analysis

In March 2023, Probe Research released its MBLI. MBLI surveyed two hundred business owners and managers in Manitoba between February 2 and 23, 2023.

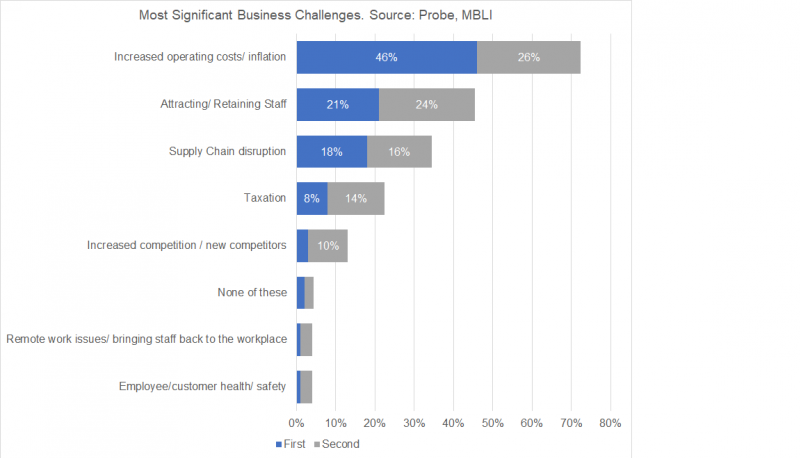

Most Significant Business Challenges

Business leaders were asked to identify their two most significant issues or challenges. Many businesses identified inflation (72%), staff attraction/retention (45%) and supply chain disruption (34%).

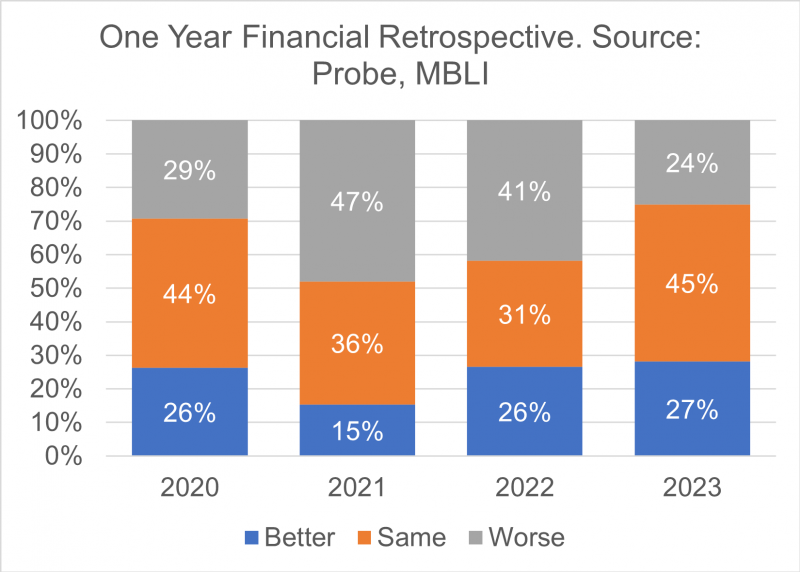

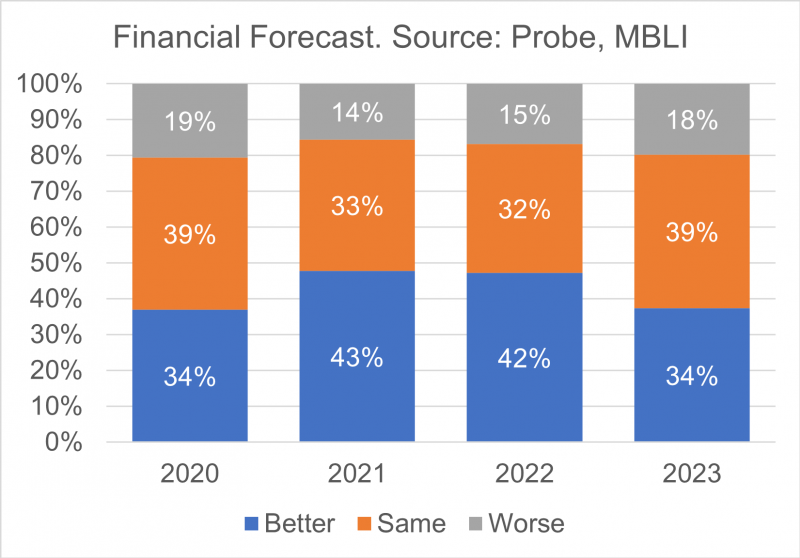

According to the MBLI, these concerns, combined with recent financial expectations, have been weighing on business’ optimism. More firms are reporting that their finances are stabilizing in 2023, while some say their finances were worse off in 2022. Looking forward, 34% of businesses predict they will do better, compared to 42% in 2022.

1. Inflation

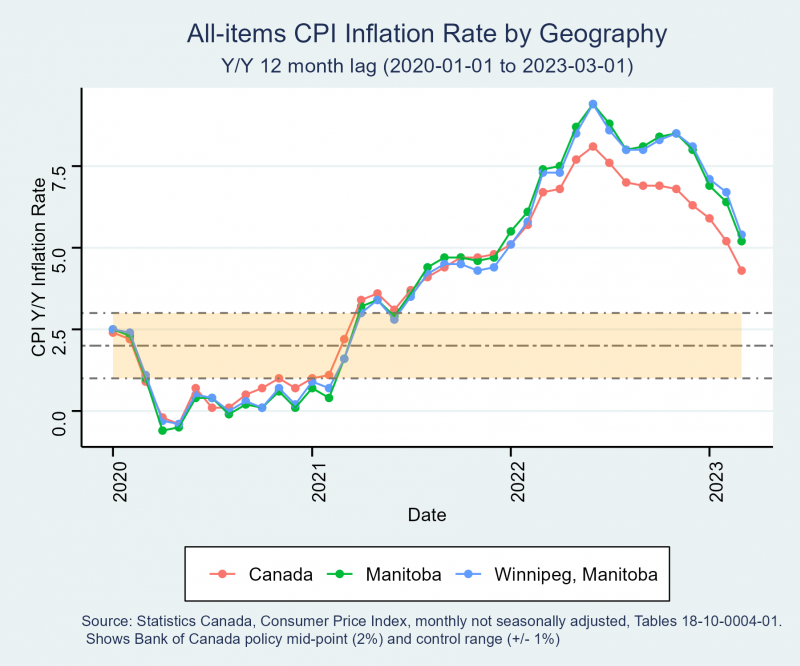

The recent peak of Consumer Price Index (CPI) inflation was in June 2022 for both Canada (8.1 per cent) and Manitoba (9.4 per cent). When Probe fielded this study, we only knew Manitoba’s inflation data from January 2023 (6.9 percent).

The inflation situation has eased since then. For example, March 2023 CPI inflation has fallen for both Canada (4.3 per cent) and Manitoba (5.2 per cent). As CPI inflation continues to trend down, we expect that inflation will fall lower on the list of business’ concerns.

What is keeping inflation high? For both Canada and Manitoba, Food, Shelter, and Health + personal care are still posting inflation numbers greater than the average. Given the biological constraints on food production (e.g., annual crop production), the food segment’s price inflation will take longer to return to a more reasonable level.

2. Problems Attracting/Retaining Staff

Attracting and retaining staff was second on the minds of business leaders. 70 per cent of firms indicated they were having difficulty finding employees; the highest since 2006’s 72 per cent, well above the 53 per cent average for 2005 - 2023. [1]

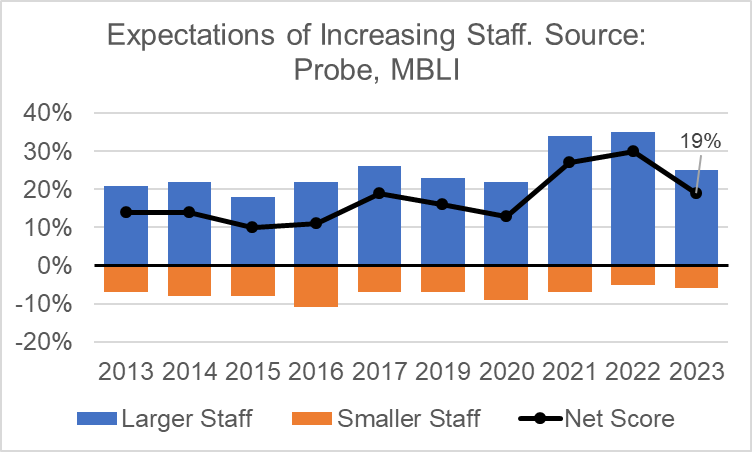

Firms also indicated slow hiring in 2023. Given the periods of re-hiring after the pandemic, this is not surprising.

Many businesses have been re-hiring employees since the pandemic lockdown, so fewer businesses are expecting layoffs or hour reductions, down to 10 per cent from 17 per cent in 2020.

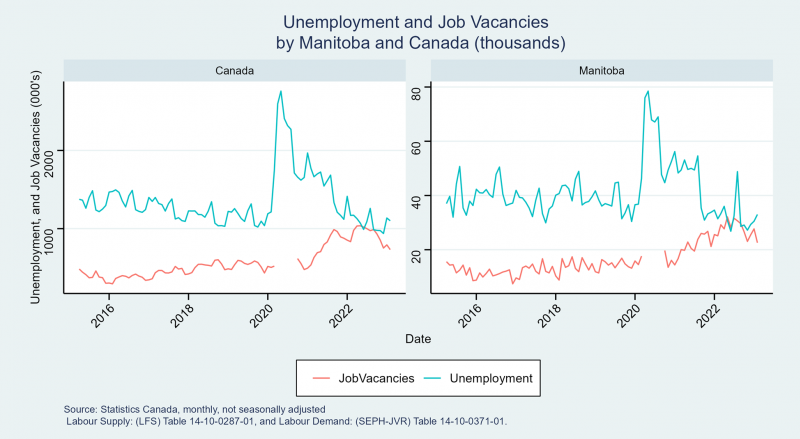

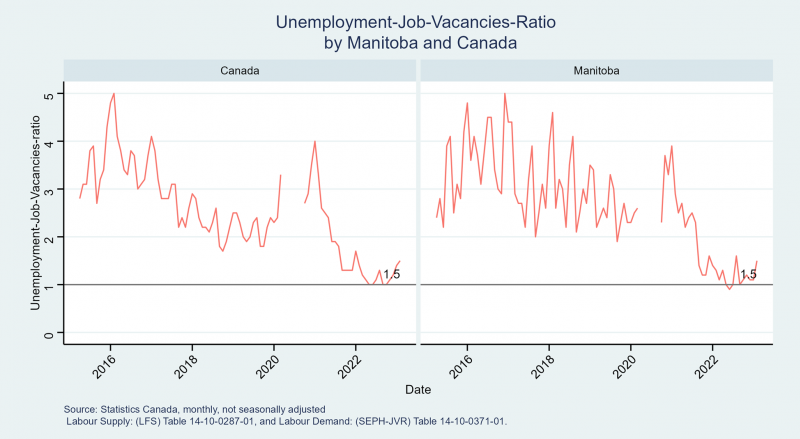

Based on the labour force survey (measuring unemployment rates) and the SEPH-JVR survey (measuring job vacancy rates), we see the following in Canada and Manitoba:

- Job vacancy rates (a measure of labour demand) have peaked post-pandemic and are trending down across all industries.

- There is an overall decrease in unemployment (a measure of labour supply) since peaking during the 2020 pandemic lockdown. The latest measurement of unemployment from February 2023 shows a slight increase.

- In February 2023, for each listed job vacancy, we have approximately 1.5 unemployed workers. Since reporting on job vacancies lags by two or three months, businesses referred to a ratio much closer to one when answering the MBLI.

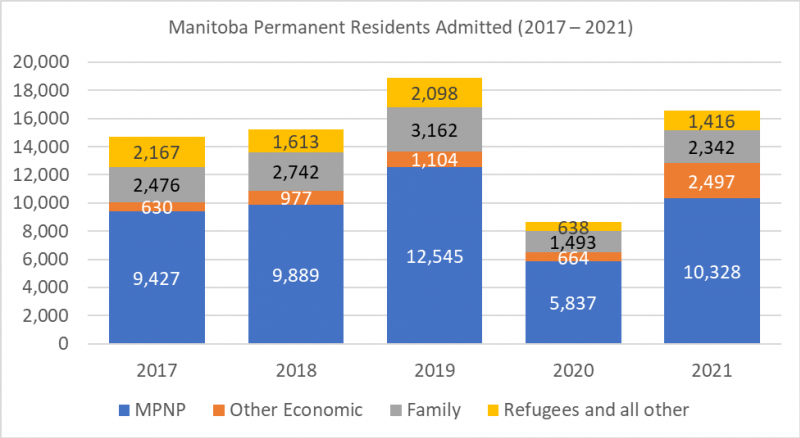

Both employees and employers will be better off if more vacancies are filled by unemployed people. Due to the pandemic, the number of immigrants coming to Manitoba decreased considerably (see chart below). [2] As the labour supply increases, businesses should be able to fill jobs they struggled to fill post-pandemic.

3. Supply Chain Pressures

The New York Fed’s Global Supply Chain Pressure Index (GSCPI) peaked on November 2021 at 4.32 standard deviations (sd) away from the mean score and has been trending down since. In February 2023, the GSCPI went negative for the first time since January 2020. In March 2023, the GSCPI was -1.06 sd away from average.

In Canada, there are currently pre-existing issues from before the pandemic, such as truck driver shortages, which require further work.

End Notes

- This was during the Go-Go! days prior to the Global Financial Crisis.

- Source: IRCC (2018 – 2022) “Annual Report to Parliament on Immigration,” Table 3, Link. IRCC = Immigration, Refugees and Citizenship Canada. While we have not included the figures here, anecdotally there were similar effects on non-permanent residents and foreign students coming to Canada.