Winnipeg Economic Digest (WED), Volume 2, Issue 1

Bottom line

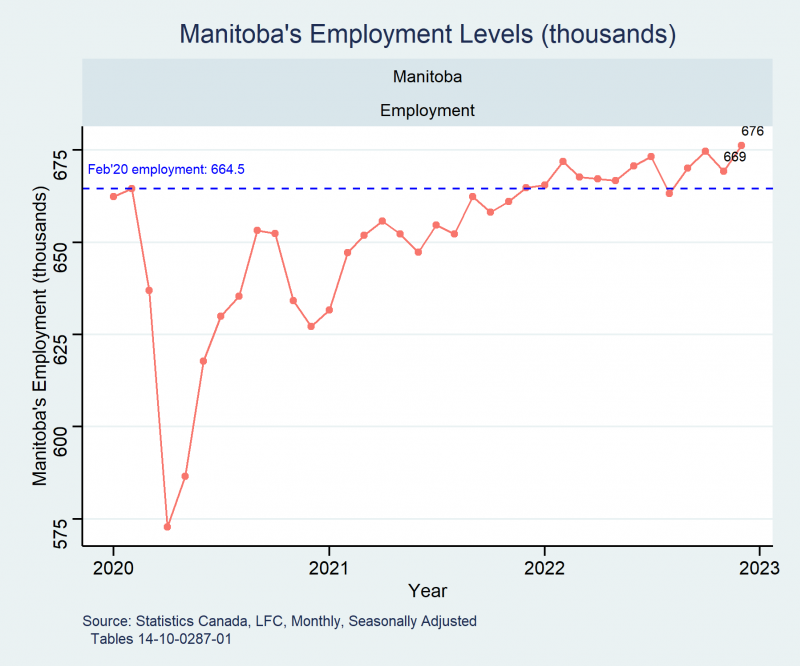

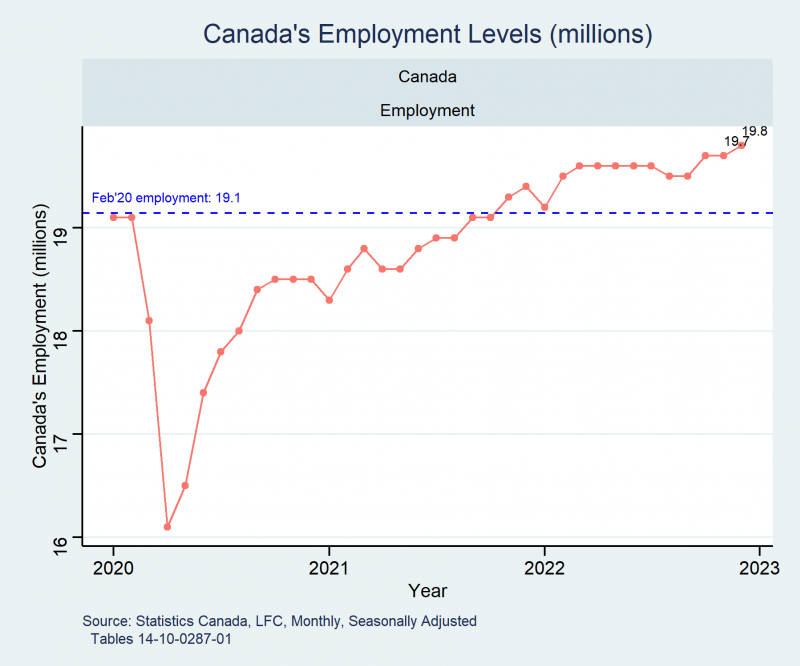

Canada and Manitoba’s employment levels are both above the pre-pandemic February 2020 levels, although Canada’s level expanded by 3.3 per cent and Manitoba by only 1.8 per cent. Manitoba’s numbers are not as high as the national average partially because the province’s working-age population growth rate was 2.4 per cent, a full percentage point lower than Canada’s 3.4 per cent. This growth is still good news for Manitoba, as it means that employment has increased in the province.

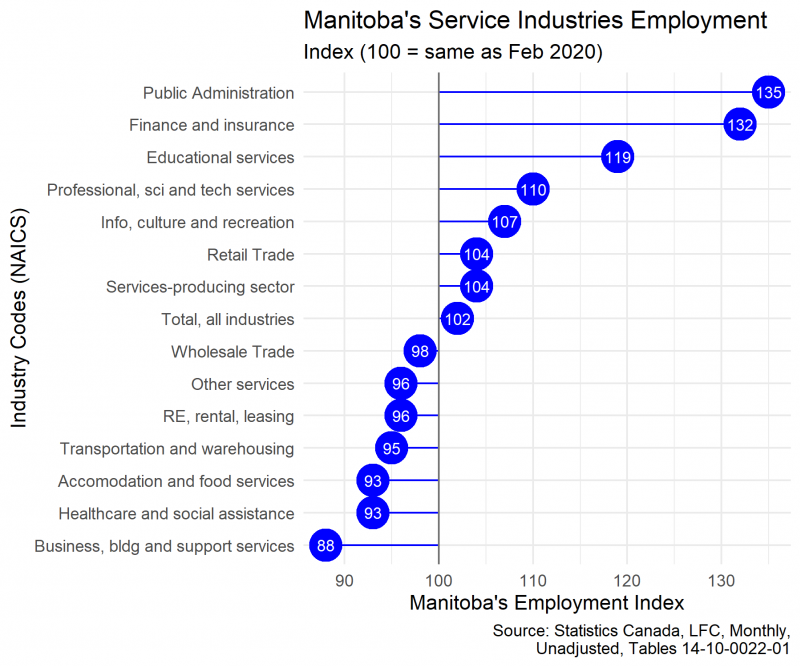

Employment growth for public admin, finance and insurance, and educational services industries has been strong in Manitoba. Meanwhile, employment in the business, building and support services industry has declined. This decline may be driven by the work-from-home (WFH) trend that has seen offices less occupied than what had typically occurred for low unemployment rates.

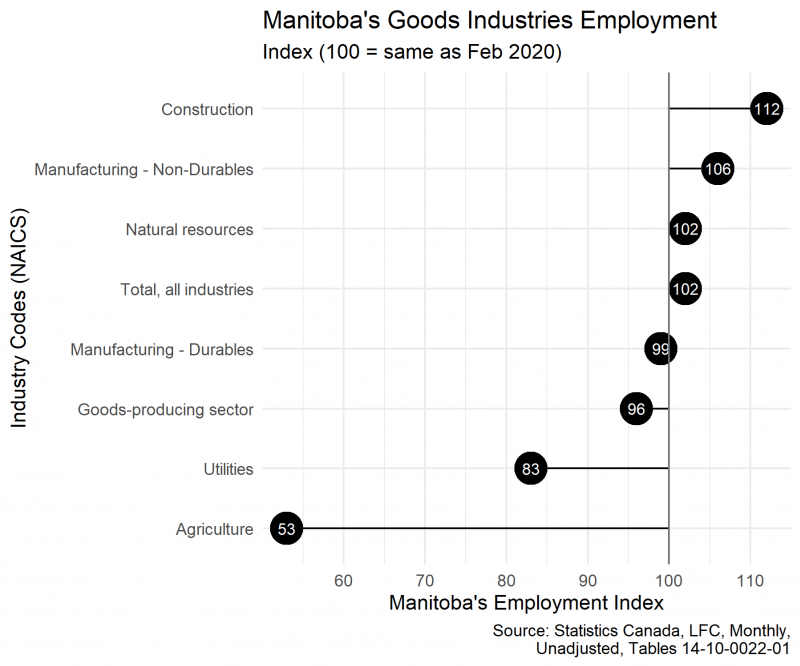

The one industry experiencing a significant decline in employment compared to its February 2020 statistics is the agriculture sector. While some of this is strictly driven by industry specific factors, the strong labour demand by other industries may also be crowding out hiring by the agriculture sector. This bears further study.

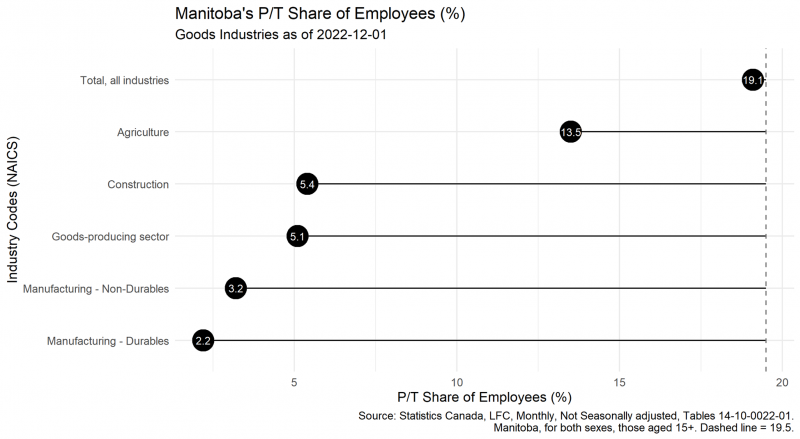

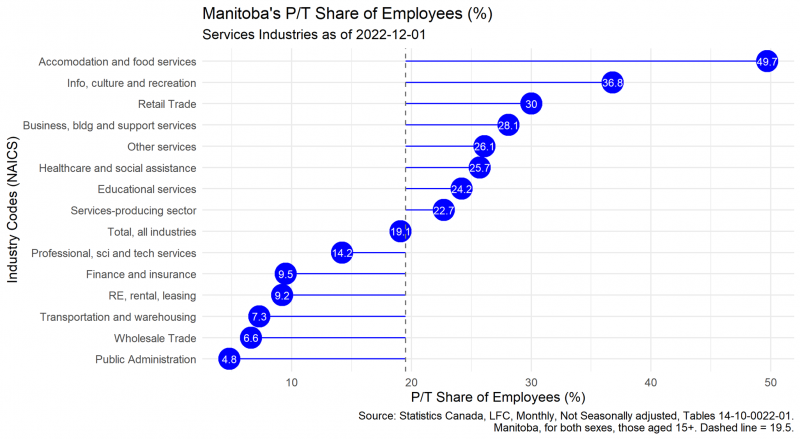

There are marked differences in the share of those employed part-time (P/T) by industry, with goods industries typically having the lowest P/T share, and select service industries having P/T shares greater than 30 per cent.

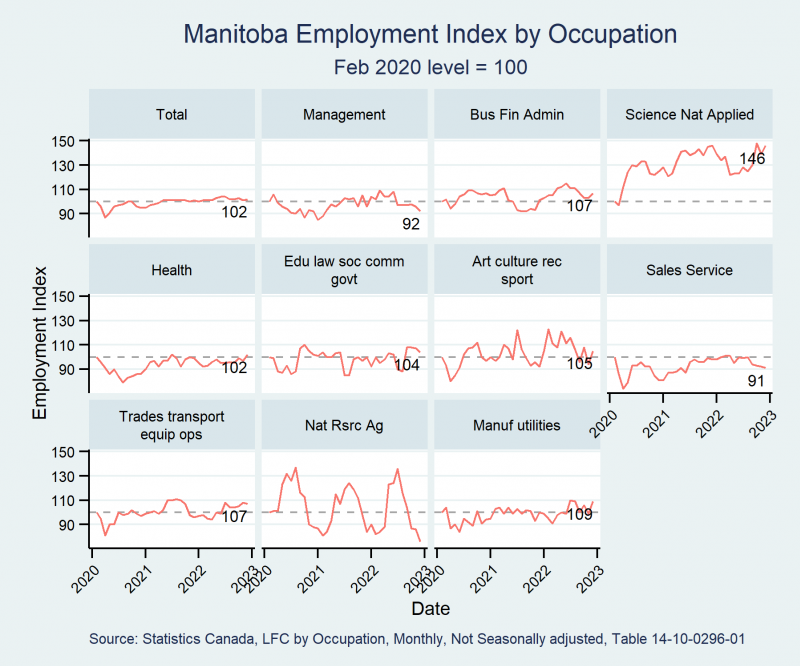

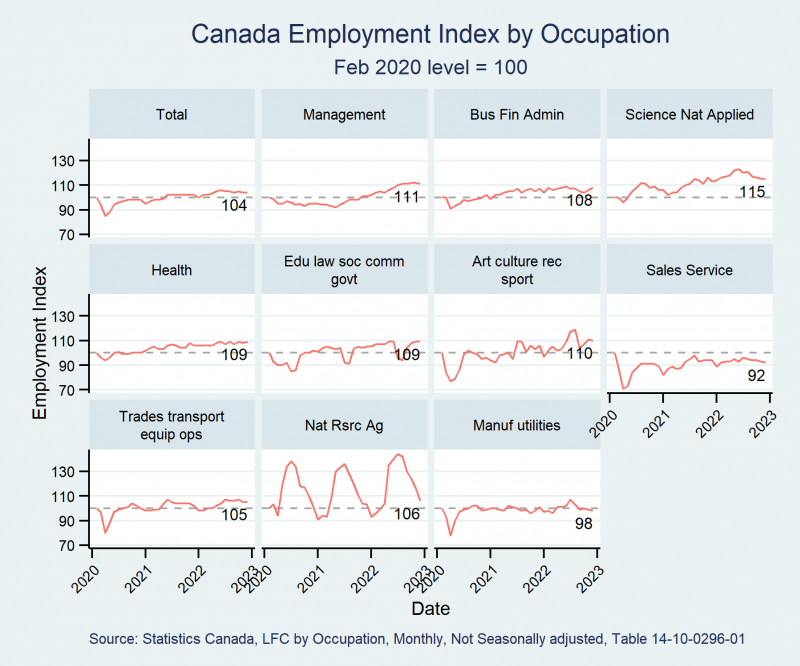

When it comes to employment by occupation, Manitoba’s one outstanding gainer by occupation grouping is sciences: (natural and applied) . This is up 46 per cent since February 2020.

Analysis - Labour force survey – December 2022

The December 2022 Labour Force Survey was released January 6, 2023. On a seasonally adjusted basis, Manitoba’s employment rose to 676,000, up from 669,000 in November. This employment level was up 1.8 per cent from its level in February 2020. Manitoba’s participation rate was 66 per cent in December 2022.

Canada’s December 2022 employment rose to 19.8 million, up from 19.7 million in November, representing a 3.3 per cent boost from February 2020. Canada’s participation rate in December 2022 was 65 per cent.

Employment by industry

Employment in the construction industry has posted the strongest gains in the goods producing industries, up 12 per cent vs February 2020. This was driven in part by strong residential construction, and industrial/warehouse building activity.

Manitoba’s agriculture employment has continued to fall on an unadjusted basis. Its December 2022 level of 13,300 is 47 per cent below its level of 25,100 in February 2020. An article by Ed White in the Western Producer on October 14, 2022 raised this as a concerning issue, and it seems to be worsening here in Manitoba. Canada’s decline in agriculture workers was 27 per cent for the same period. [1]

Manitoba’s agriculture employment has continued to fall on an unadjusted basis. Its December 2022 level of 13,300 is 47 per cent below its level of 25,100 in February 2020. An article by Ed White in the Western Producer on October 14, 2022 raised this as a concerning issue, and it seems to be worsening here in Manitoba. Canada’s decline in agriculture workers was 27 per cent for the same period. [1]

The earlier drought was likely associated with the decline in Manitoba’s agriculture sector, but there are probably other issues as well. The primary agriculture sector and its supporting organizations should consider examining the decline to uncover the issues, and determine if the sector needs to find other ways to market to potential employees. The strong hiring push by other industries may be crowding out agricultural hiring. Given a decline of 27 per cent at a national level, the Canadian agriculture sector should likely consider conducting broad analysis. [2]

The services sector posted strong gains in December 2022 versus February 2020 in multiple industries. The public admin industry gained 35 per cent in employment, finance and insurance gained 32 per cent, while educational services gained 19 per cent. The largest decline is for business, building and support services, which was down 12 per cent.

Unemployment rates by geography, sex and age group (not seasonally adjusted)

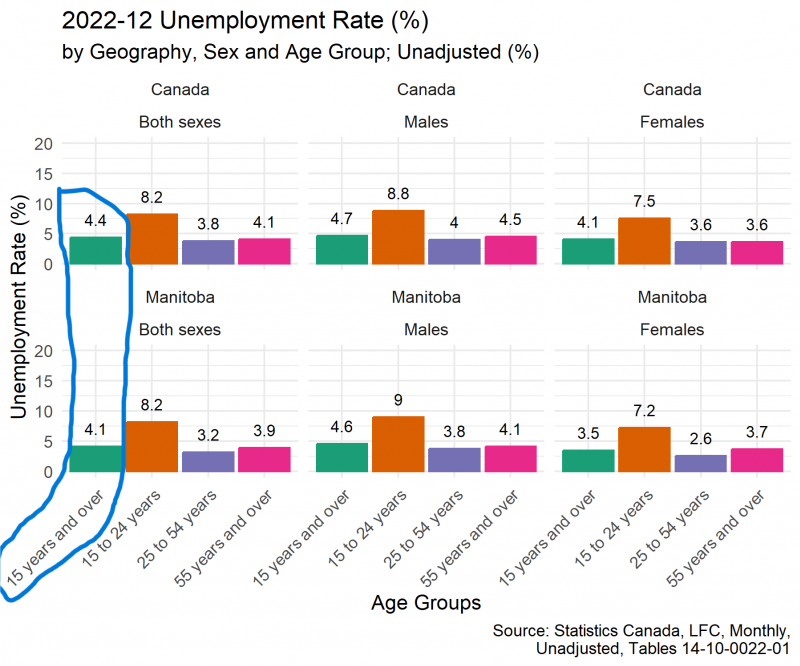

In 2022, Manitoba’s unadjusted unemployment rate was 4.1 per cent, while Canada’s unemployment rate is 4.4 per cent ( circled in blue above). [3] When we compare Canada and Manitoba's unemployment rates by gender and age group combinations, we see that Manitoba's unemployment rates only exceed Canada's for Males aged 15 to 24, and females aged 55+.

Share Employed Part-time by Industry

Under the goods producing industries, the agriculture sector has the highest number of part-time employees (P/T shares) at 13.5 per cent. The rest of the goods producing sectors are below six per cent.

Of the services producing industries, almost all of the P/T shares are greater than six per cent. The highest are:

- Accommodation and food services (49.7 per cent),

- Info, culture and recreation (36.8 per cent) and

- Retail trade (30 per cent).

Typically full-time positions are viewed as more stable and are often more in demand by employees as they move up the age ladder. Part-time is more common among those in secondary or post-secondary education, those just returning to the workforce (including those with young kids), and those who are reducing their hours ahead of retirement.

Employment by occupation

In Manitoba, the following occupations: natural and applied sciences (+46 per cent) is well above its February 2020 level. Natural resources and agriculture employment is still highly cyclical but is down more than has occurred in the previous two years.

In Canada, the following occupations: natural and applied sciences (+15 per cent), management (+11 per cent), and art, culture, recreation and sport (+10 per cent) are all up more than 10 per cent compared to February 2020 levels. Natural resources and agriculture employment is still highly cyclical.

End Notes

- Note that what is meant by agriculture here is the following NAICS codes: 111 (crops production) and 112 (Livestock, and aquaculture production ), 1151 (supports for crop production), and 1152 (supports for livestock and aquaculture production ). See: Statistics Canada Table 14-10-0022-01. NAICS = North American Industry Classification System.

- Looking at income and costs is likely to be telling. Manitoba’s annual stats have been flat for the past two years after a weak 2019. Statistics Canada. Table 32-10-0052-01, Net farm income (x 1,000). High costs have been squeezing farm operations even with strong crop and livestock prices. I mmigration disruptions, and competition for workers by other sectors attempting to rebuild their work forces post-pandemic may also be part of the issue for primary agriculture and its supporting industries. See also The Agriculture Stats Hub (statcan.gc.ca), and Net farm income, by province (statcan.gc.ca).

-

For Canada, this is the lowest unemployment rate since the pandemic started in February 2020. For Manitoba, this is tied for the fourth lowest unemployment rate since the start of the pandemic.